How Sovereign ESG Bonds Are Reshaping Development

- harshas2883

- Jul 31, 2025

- 2 min read

Once upon a time, development aid came through donor pledges and IMF loans. In 2025, it increasingly arrives in green — not dollars or euros, but through sovereign ESG bonds.

From Chile to Nigeria, governments are issuing these bonds not just to raise money, but to prove purpose. They promise that funds raised will directly support environmental sustainability, social equity, or strong governance reforms. But is this trend just a fiscal fashion—or the future of inclusive growth?

The Rise of Sovereign ESG Bonds in Emerging Economies

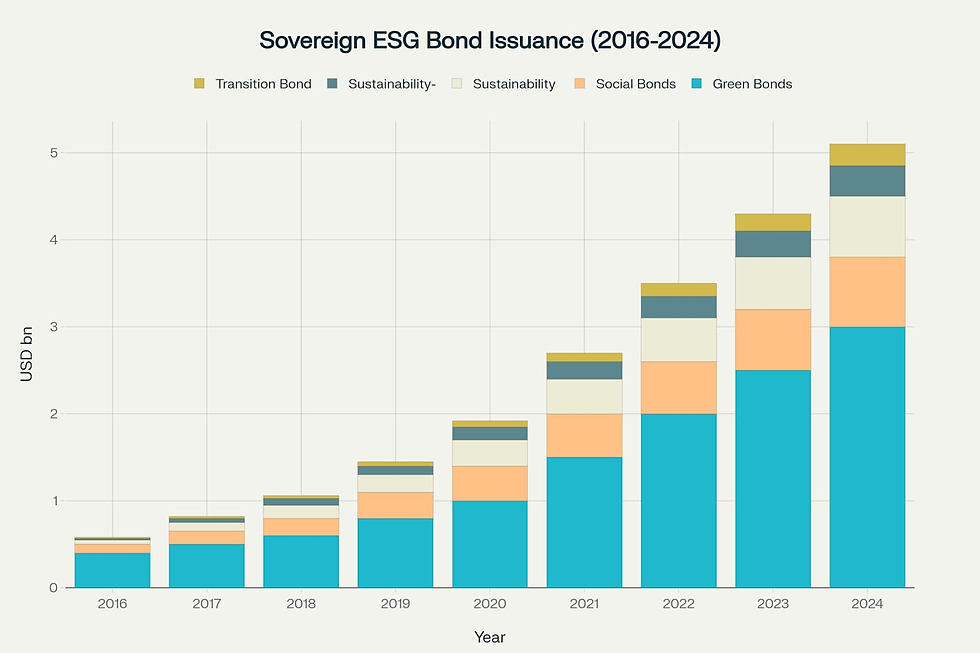

The market for sovereign ESG bonds has exploded, reaching over $500 billion in issuances by mid-2025, up from $20 billion just five years ago. And these aren’t just paper promises.

Take Chile: its green bonds have financed low-carbon transportation and renewable energy. Indonesia used its sukuk (Islamic green bonds) to fund climate-resilient agriculture. And Benin’s 2023 SDG bond helped expand universal primary education.

These aren't just feel-good stories. They’re proof that public borrowing, when tied to measurable impact, can deliver real progress.

Accountability or Aesthetic?

Here lies the challenge. Without standardized impact metrics, some governments risk using these instruments for fiscal greenwashing. Critics argue that some bonds are more about optics than outcomes.

But new frameworks from the International Capital Market Association (ICMA) and the EU Taxonomy are changing that, pushing issuers to report on results, not just intentions.

Why It Matters to You

These aren’t abstract finance tools — they affect how roads are built, how schools are funded, and how climate justice is delivered.

If you're an investor, this is your chance to back purpose with profit. If you're a citizen, demand that your government borrows for good. And if you're a policymaker, embrace the tools that tie your budgets to your values.

Comments